The RBA has given us a subtle hint as to what they really think.

So I don’t expect a lot of cred for picking last week’s rate cut. A lot of people saw that one coming.

Where things get interesting though is what people think it means, or what it says about where the economies at, and what the RBA is likely to do with rates.

It can get tricky to get a read on what the RBA is thinking. They are very political with their words, and very careful not to say anything that might ‘excite’ markets.

It can be tricky to read through the boredom of it all.

For my money I like to keep an eye on their charts. The charts aren’t prone to the same kind of subjective confusion. (Is growth ‘solid’, or just ‘modest’?) The charts are also prepared by the economists closer to the data, so they way they set them up can give you a bit of an insight into what they’re really thinking.

And so with the chart-pack and SoMP that went with last weeks rate cuts now in our hands, let’s take a look at what the RBA really thinks.

(I might add my own extra-colourful commentary as a counter-weight to the RBA’s snooze fest.)

First up, looking at the global context, things look ball-tearingly good.

Global growth is slowing, but the RBA is keen to point out that our major trading partners (which is what really matters for Australia), have been steady tracking around 4% since the GFC. Nice.

Growth in China is slowing (though is still at creamy highs), but look out Mr Ming, here comes India.

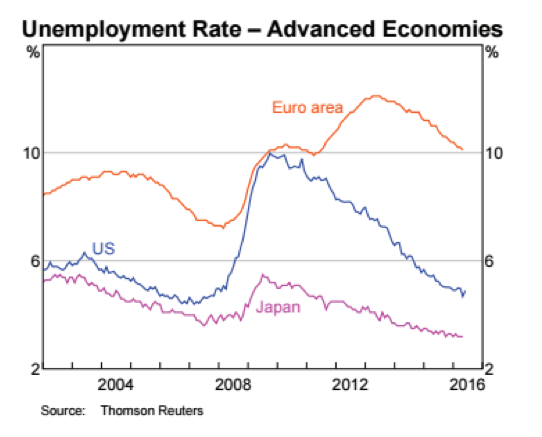

And if you look at unemployment in the 3 biggest economic regions, it’s just heading into sunnier and sunnier pastures.

So the short of it is, the global economy is cheering Australia on like a rabid pies supporter. There’s nothing to complain about here.

Likewise on the domestic front. If you look at GDP growth, we’re growing at around 3%, which is slightly lower than long run averages, but everyone is growing a little slower these days. This is really about as much as we could hope for.

At the same time, inflation has become a total daisy-cutter. Again, this is a global phenomenon, and there’s was probably no avoiding it. It would be a problem if it heads too much lower, but for now, low and stable inflation is awesome. It helps businesses with their decisions, and it keeps interest rates low, so, you know, winner.

But that’s not to say we don’t have our challenges. These challenges are mostly around the mining boom that continues to deflate like a whoopee cushion. Mining profits have gone over the edge…

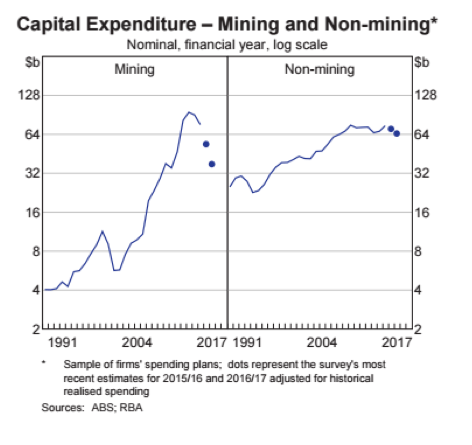

And CapEx (investment projections) are in free-fall as well…

It’s worth noting that the non-mining economy is holding ground, but that won’t be enough. Unless we get a sizeable pick-up somewhere else in the economy, the deflating mining sector could well drag us into recession.

There’s has been a lot of support from the building industry, though this has mostly come through the high-rise apartment boom, which seems to be coming off the boil now.

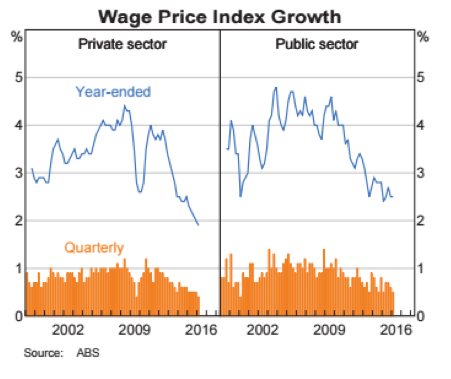

And there’s not a lot of hope for households coming roaring over the hill to save the day. Wages growth continues to fall, and is tracking around historic lows. The private sector panel is positively scary.

That kind of wage growth might be hard to square away with the unemployment rate, which is steady at a reasonably healthy level. If the labour market is pretty healthy, why are wages such a fart in an elevator?

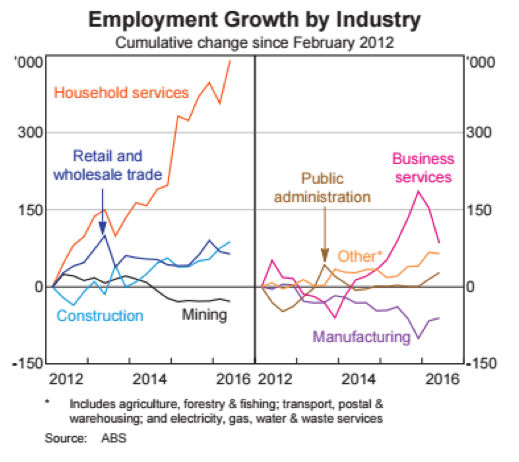

It seems that what is happening is that the job market is churning, with higher paid jobs in mining and manufacturing being replaced by lower-paid jobs in household services. Less miners, more baristas.

I’m not sure if this is such an exciting vision for the economy. The RBA doesn’t seem to think so.

The last point the RBA wanted to make was about interest rates. They note that official interest rates are steaming lower, but actual chalkboard interest rates are drifting down like a dreamy feather.

All because the banks are protecting their net interest margin (the difference between lending and borrowing rates, i.e profits) at all costs. They’ve hardly moved.

This will be complicating the RBA’s job, but actually probably makes things easier if anything. There’s always the danger of sparking another mining boom, so bank gouging will dampen that prospect.

So that’s the story. The global economy (occasional jitters aside), is actually very supportive for growth. And for the moment, the Australian economy is doing pretty well, growing strongly and generating jobs.

However, the transition from the mining boom remains a headache. Mining companies are a drag on investment and corporate profitability, and we’re shedding jobs in our productive sectors, though this is being slightly off-set in tertiary service sectors.

If these trends are left unchecked, then the growth outlook in 12 to 18 months starts to look a bit grim, especially if the Aussie dollar keeps drifting higher.

And that’s why we needed a rate cut. And why there’s a good chance we’ll see another one before the year is out.

That’s what the RBA really thinks.

Agree with their assessment? Are they too glass half empty or glass half full?

Jon,

With all due respect, you are too naïve to think that:

RBA is setting rates on their own,

RBA is owned by Australia,

Most economic measures (eg. GDP, CPI unemployment rates etc. are correct.)

Most statistical figures are true and reliable.

For example, in US the unemployment rate is well over 25% (1 in 4 people who can work is unemployed) and over 40,000,000 people on food coupon.

So called, some/most knowledgeable economic and other “experts” writing non-sense BS material and sadly most people are buying into it.

Couldn’t agree more Edd.

Headline numbers are manipulated and adjusted within an inch of their lives, but no-one seems to look below the surface of the mainstream media BS.

Everything is politically driven to paint a much rosier picture. Unfortunately the truth is just too ugly for the sheeple to cope with.

Edd, Further to your comments, most of the global “growth” is nothing but a sugar hit from the massive debt/money printing going on. You can keep someone running on a treadmill if you feed them Redbull and inject them with adrenalin, but eventually the reality of that catches up and you’ll have one dead runner. The day of debt reckoning is coming and it is not going to be pretty.

I 100% agree with Ed. The figures the government are pumping out are total BS.

The blue dots on the graph on mining capital expenditure plans bear little resemblance to reality. From the graph this years capital expenditure is meant to be around the same as 2010 but in reality there has been a major drop off in capital expenditure as shown by the number of shut down or severely cut back engineering companies in Perth. There are huge numbers of mining related jobs that have been made redundant. Maybe there is still some spending on capital that was committed in better times (e.g. Roy Hill Project) but theres not much new capital spending on mining.

It is strange that the lowering of interest rates has not resulted in inflation. Where is all the money from money printing going? It seems to me its going into pumping up asset prices on things like shares and Sydney and Melbourne house prices. That money printing is not going into creating real wealth that in turn generates jobs.

It is high risk to borrow much at these low interest rate as some time in the future interest rate increases will be a real killer and job security is at an all time low.

Major overseas banks are at risk of failure because of their huge loans to the multitudes of basket case economies. Tax payers are presently bailing out the banks around the world. Money in banks and superfunds is not safe from governments taxation grabs.

Clearly the government and reserve bank have run out of ideas for stimulating the economy and a different approach is needed. Shutting down our car and other manufacturing industries while opening ourselves up for unfair competition through free trade agreements is sheer madness. It is even more madness for the government to then borrow from overseas to finance the resulting social welfare costs. Its about time our industries are protected from unfair competition and people that work aren’t taxed to the hilt.

oh jon you are such an optimist. rba setting interest rates? janet y tells us ..cos our r.b. is but a branch of the ‘fed’, which i iterate again and again is a private criminal organisation set up in 1914. jeez can’t you just see it for what it is? george orwell (mr. 1984) put up a cartoon with lots of people walking down the street wearing tv sets on their shoulders (in lieu of heads lol) and the caption was that people believe anything on tv etc. morons..no..’goyems’..jewish for dumb ones. and russia..everybody i speak to says ..oh bad bad people. WHY?? now what have they really done to deserve the bad image? pres. putin states again and again that he wants peace and to develop his country for his people to live better than they do now. mr ercegon(?) turkish president is all smiles for putin cos mr. p just saved his life..now two c.i.a. pilots are under arrest pending a trial. mr. e wants to kill obama now and is joining forces with russia. this is a disastrous move for usa. anyway out of all of this cafuffle i can see interest rates going though the roof in the new year. americans are again refinancing their houses at a rapidly

increasing rate…shades of 2007..just to make ends meet. world picture? get out of debt!! assetisation.(is that a word?) is el finisimo:-) house prices going down 50% ..you don’t believe? ok dream on jon.

I agree with the comments. With all the Census uproar it’s not too far fetched to believe the ABS can rename itself the Aust’n Bureau of Surveillance; with all the data it’s going to capture and store for a prolonged period of time – could be hacked by Russians or sold off to foreign investors as we slip further into astronomical foreign debt/banana republic…

The ABS data base is so Basic its NOT any invasion of privacy. We should have an Australia Card.

Every supermarket links EVERY purchase to every plastic credit/debit card which knows your age, address total buying patterns and this information is For Sale to ALL Marketing Organizations.

All ABS primitive data simply plans new schools, hospitals and major infrastructure. Marketing knows everything about you and your family. Not the ABS. Gosh to “worry” about ABS data is such a minuscule thought, really when you know what is actually “For Sale” out their right NOW for a price.

Congratulations Your collection of data so well “contained” in one article its impressive. Just ALL jobless and CPI stats are way out. A Full time employee is 20 hours of work per week. They work BUT cannot eat on only 20 hrs per week. Such rampant under- employment exists and manipulated by all governments. Same as the CPI is massively understated by changing the “basket” of items being measured. Underemployment is probably 20%, CPI is double the “stated” figures worldwide. Lex