I’m not going to make any friends with this – probably lose a few in fact.

I’ve never been shy about making enemies before. If you want to bake a cake you need to break few eggs.

But enemies with serious money behind them? That’s another thing. And if we’re talking about a lot of enemies with a lot of money..? Well, then its time to review your security systems.

I’ve been sitting on this report for a little while. Some people in my team were pushing me to publish earlier. Some of them wanted to can it altogether. I almost pulled the plug on it a few times.

But I’ve decided to come clean.

In this report I’m going to blow the lid on one of the greatest scams of the century so far.

I’m going to show you how ordinary investors have been played in order to protect the interests of the rich elite. Like pawns, their financial futures were sacrificed to line the pockets of people who had already made their money.

Truth be told, people like me.

I’ve been awake to this scam since the get go – which is one of the reasons I’ve been able to do as well as I’ve done. But I’ve never stood up publicly against it before.

You do what you can do. You make sure your friends and family aren’t falling into the trap. You invest in education programs that give people real alternatives. But it is a scam so entrenched, so protected by power, that I felt I was helpless against it. What can one man do?

And so I did nothing.

But that was then. Now, I’m sick and tired of seeing people being taken for a ride, year after year. And now that I’ve developed a voice as one of the most widely-read property bloggers in the country, I feel a responsibility to use that position for the greater good.

I’ve found a voice and I’m going to use it.

And it starts with this report.

I’m going to show you just how the scam works. I’m going to show you who wins and who just gets played. And I’m going to show you just what you can do to keep yourself from becoming another victim.

So, what am I talking about?

NEGATIVE GEARING

The greatest trick the devil ever pulled…

Now I can hear the cries already. “What’s wrong with negative gearing?” “It’s income tax 101” etc. etc.

And personally, I’m not against negative gearing. I’ve used it a lot myself.

But this is the real genius of this scam. It’s impossible to talk about without talking about negative gearing, but negative gearing is not really the problem.

It’s just the tip of the iceberg.

And because of the way negative gearing works and its role – effectively making mum and dad investors feel ok about carrying loss-making properties – it has become a very energised topic. And the vested interests that benefit most have worked hard to make sure that it stays an energised topic.

And in all that energy and hoo-ha around negative gearing, they’ve managed to distract the country from the real issues involved.

Take the 2016 Federal Election. Negative gearing was one of the hottest of the hot-button topics. But it a total pantomime. Labor decided to propose negative gearing reform to differentiate themselves from the Coalition. Turnbull and Morrison also wanted to reform the ‘excesses’ of negative gearing, but they were rolled in cabinet so the Coalition could attack Labor “with clean hands”[1].

As far as the rich and powerful are concerned, there’s no debate. The negative gearing “debate” is nothing orchestrated theatre. Nothing but smoke and mirrors.

But let’s take a little peep inside the magician’s box.

I’ll get to the actual mechanics of the scam in a moment, and show you just how Joe Public’s been taken for a ride. But to appreciate how beautiful the scam is, we need to step back and see it in context.

The Puzzle

Here’s a question for you. Have the past twenty years been good years for the Australian property market?

Unless you’ve just been born, you’ll know that the answer is a resounding ‘YES’. On a global and historical scale, the past twenty years have been one of the great bull runs of all time. House prices have effectively triple since 1986.

So there has never been a better time to be a property investor… ever… in the history of the world. All of this should have sparked a virtuous cycle of equity and leveraging power, and Long Island Ice Tea’s around the pool at sunset.

But it didn’t.

This is the great puzzle of our times. If these have been the best times to be a property investor in the history of humanity, why haven’t investors done better?

And by better, I mean, why haven’t they used these conditions to expand their portfolios, develop passive lifestyle income plays, and put their feet up?

What the data shows is that 95% of investors don’t get past two properties. Of those that do, most don’t do all that much better. Only 2% of investors get to four properties. And less than 1% (or 0.068% of the Australian population) become portfolio investors with 5 or more properties.

The question is why.

If these have been the best market conditions in history, why have 95% of investors not been able to get past two properties?

The answer?

Negative Gearing.

Everybody’s doing it…

I don’t think people realise how common negative gearing is.

Two-thirds of investors report an income loss on their investment properties. The average negatively geared investor loses $10,947 a year or $210.50 a week.

Many lose a lot more.

… and everybody’s getting screwed.

Negative Gearing was sold to investors as a “professional” play. Like one of those B.S stories at the car lots when you get to see the fleet manager to get a better deal. They see you coming from a mile off.

But investors thought they were playing with the big boys. It was a clever way to mess with the tax man, and that’s what rich people do, right? Therefore, if I’m messing with the tax man, I’m playing like a big boy.

You’re not playing like a big boy. You’re playing right into their hands.

I’ve written a lot over the years about why negative gearing is a dud strategy – about the way people underestimate the operating losses involved, or the way it leaves them exposed if something goes wrong – like someone losing an income, or banks increasing rates. So I won’t go into it that again. But it doesn’t really matter. Far and away my biggest gripe with negative gearing is just that it is a portfolio killer.

If all your properties are bleeding cash, at some point the banks are going to stop lending to you. You hit up against a serviceability ceiling. You can only lay so many negatively geared properties on your income’s shoulders.

(And looking at the data, my guess is that that number of properties is 2!)

And the truth is that macro-economic factors have done a lot to disguise how dangerous negative gearing is. With interest rates on a steady downward run and rents growing at a decent clip, negatively geared properties can become positively geared in a few years. And once they become positively geared you can start investing again.

But interest rates are getting tapped out and rental growth is stagnating, so I don’t think we can rely on those macro-economic tail-winds going forward.

That means investors are playing with fire. If our obsession with negative gearing continues, two-thirds of property investors are going to find themselves seriously exposed.

So this isn’t an argument about what’s good for the country, what’s good for the market, or what’s consistent with taxation code or any of that. This is only about whether negative gearing is good for you – as an individual investor.

And the numbers speak for themselves. Through one of the great property bull runs in history, 95% of investors couldn’t get past two properties.

So that raises the question. If it’s not serving individual investors, who is it serving?

The CGT tango

This is where my accountant becomes one of those enemies I was talking about.

To understand how the scam works in practice, we need to understand how negative gearing works with the Capital Gains Tax discount.

As I said, negative gearing is not really the issue. We’re just made to think it is.

I think this stuff is dense and boring by design. It’s difficult to penetrate, which is why it has survived so long. But I’ll try keep it as simple as I can.

The 50% CGT discount was introduced by the Howard Government in 1999, and it was what allowed negative gearing to be used as a “sheltering tax haven” (in the words of Malcolm Turnbull, back when he was a back-bencher and could say what he liked.)

The drop off

The basic idea is that you arrange your affairs so an individual property is making a loss. You claim the loss against your income, which saves you 45 cents in the dollar, and ideally, drops you down into a lower tax bracket.

The pick up

You get your money back when the property appreciates in value and you sell it. The 50% CGT discount effectively means you’re only pay tax on half of the gain. That’s another way of saying you’re only paying half of the tax (half of your marginal tax rate) on the full gain.

The net result? If you play your cards right, you’ve paid half as much tax on that portion of your income than you otherwise would have. Nice.

I’ve used this strategy more than a few times myself.

Now you might think there’s nothing wrong with this, since the option is open to everyone. But the reality is that the negative gearing / CGT tango is a lot easier to pull off if you have deep pockets.

You have much more scope to arrange your affairs in the right way. You can wear rental losses for a long time and your not going to get caught out by market movements. Deep pockets and a large portfolio of properties means you can set up the right financing arrangements, and you also have more flexibility around when you enter and exit your trades.

There’s a lot to this, and I usually leave all this to my accountant, but if you want an idea of how well the NG/CGT tango serves the rich, have a look at these charts here.

We know that a higher portion of negative gearing losses, and negatively geared taxpayers occur at higher taxable income levels:

However, this is taxable income, so it is after negative gearing deductions have been included (which are often only there to reduce taxable income in the first place). So this muddies this picture.

We also know that higher income earners have much higher negative gearing losses. As I said before, the average loss is about $10,000 a year. But the average loss for people earning more than a million dollars a year is over $45,000.

It certainly looks suspicious. But you know, maybe if you’re earning a million a year you have more properties, or fancier tastes.

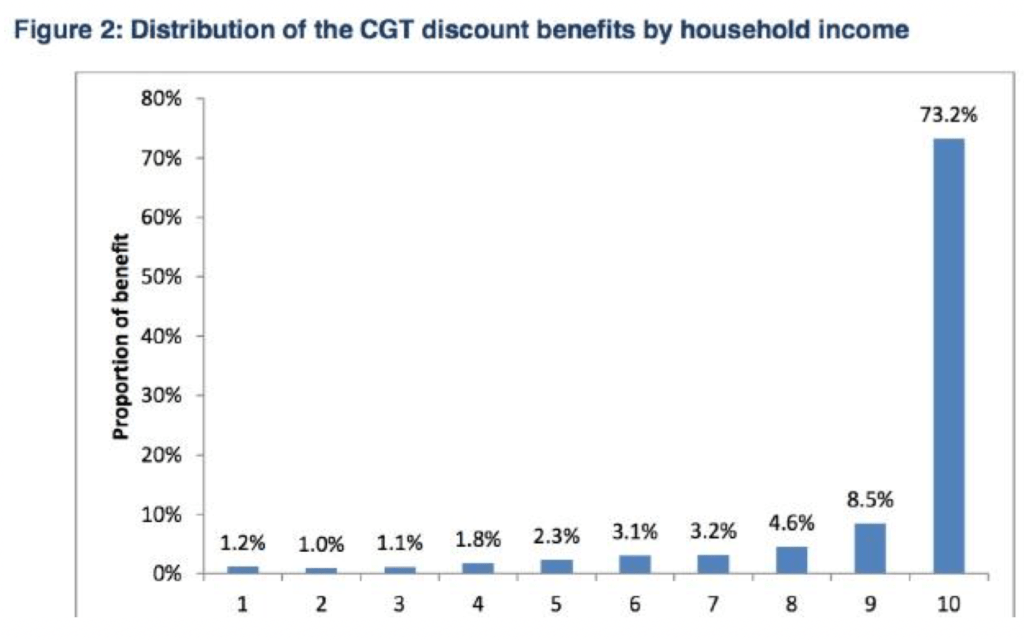

The crux of it is here – the distribution of Capital Gains Tax discounts. Almost three-quarters of the CGT discount benefits go to the top 10% of income earners.

So negative gearing is skewed, but the CGT discounts are off the hook! The capital gains tax discount overwhelming favours the rich – and I mean the very rich.

Rich people like me.

So the NG/CGT tango is a tax dodge for the rich. Pure and simple. At last count, it cost the country over $13 billion in lost taxation revenue.

That’s serious coin.

And every time this comes up, the same old lines get trotted out – that negative gearing mostly used by mums and dads and “ordinary” investors – policemen and nurses and so on.

But which electorate do you reckon uses negative gearing the most?

Wentworth.

Yep, Malcolm Turnbull’s plumb electorate in the Eastern Suburbs of Sydney. The last time I was sitting in a café in Vaucluse, overlooking the sunny harbour, drinking an $18 a glass chardonnay, I wasn’t thinking, yep, Battler Heartland.

Here’s a bonus thought for you. Every state and territory in Australia reports an average rental loss at the moment. But where is the biggest average loss?

Canberra.

Do those politicians know something we don’t?

Getting played like a fiddle

And that’s the thing about the negative gearing debate. So long as there’s a negative gearing debate, there can’t be a CGT discount debate. But the negative gearing ‘debate’ is so energised and noisy, that we never get to the crux of the issue.

Genius.

At the same time, the rich elite have mobilised an army of mum and dad investors to defend their interests for them. If you’ve got a negatively geared property, you are deeply invested in the negative gearing regime. If negative gearing goes, all you’ve got is a property bleeding you of cash.

No one wants that.

And so even though the benefits of the NG/CGT tango overwhelmingly go to the rich, and even though negative gearing has hamstrung a generation of investors, the most vocal defenders of the system are the ones the system is failing to serve. (Isn’t it always the way?)

I’ll let you in on a secret. None of this was an accident.

You’re getting played like a fiddle.

Armed with paper swords

One of the amazing things about this campaign to protect the NG/CGT tango is the amount of misinformation out there. Here’s a couple of myths:

Negative Gearing helps bring Supply to the market

The truth is that 93% of investors buy existing properties. Only 7% buy new properties that increase the housing stock – owner-occupiers do much more heavy lifting here.

Removing Negative Gearing will cause House Prices to Fall

This is inconsistent with the first claim, but it doesn’t stop people trotting them out in the same breath. If the first is true, then removing negative gearing should reduce housing supply, and prices should actually rise.

But the first isn’t true, and it seems negative gearing does little for supply. That means it should have little impact on prices… or rents…

Rents soared last time we removed negative gearing

This is one of the most popular myths, and refers to the time Labor removed negative gearing between 1985-1987.

The truth of it is that it was a mixed bag across the states during this time. Rents rose in Sydney and Perth, but fell in every other capital city, leaving the national market flat over all.

If negative gearing had any impact on rents, it certainly wasn’t consistent from city to city, and you can’t see it here in the data.

But if it wasn’t about the so called ‘landlord strike’, why did Labor reinstate it after just two years..?

… Remember those powerful vested interests I was talking about?

Shit is getting serious…

So it might be tempting to say, so the rich are screwing the poor. That always happens. At least no one got hurt.

And that’s true to an extent.

But from where I stand, I see a generation of investors who never found a way to make property work – who never made it a vehicle for true financial freedom.

In my eyes, that’s a crime.

What’s more, the system has enjoyed a lot of cover from the macro-economics over recent years. Interest rates were falling, rents were rising. That made the negative gearing strategy look a lot better than it actually is.

But a lot of that cover is evaporating.

Take interest rates. Interest rates have fallen steadily over the past decade or so, to a 50 year low. But they can’t go all that much further. As a small open economy we can’t go to zero like the big boys, so that means rates could fall another 1 to 1.5 percentage points at most, and that’s even if they do fall.

Once you’ve hit rock bottom, there’s only one way rates can go: up. That means there’s going to be very little help for negatively geared properties in the years ahead.

Or take rents. In a low interest rate environment – the yield on assets is also low, since the first is a foundation for the second. We’re seeing that with rental yields, that have also fallen to historical lows in recent years.

This is keeping downward pressure on rental growth. That leaves wages growth to do the heavy lifting in driving rents, but wages are going nowhere.

And so rental growth has been falling since the GFC. In fact, in the detached housing market, rental growth has recently turned negative for the first time since records began.

Rents are already falling.

This has serious implications for a negative gearing strategy. If interest rates hold, and rents go nowhere, then a negatively geared property remains negatively geared… indefinitely. It’s negatively geared til one of those things improves.

So for the time being, that means investors can’t rely on macro-economic forces turning their negatively geared duds into positively geared cashflow performers.

But even that’s a reasonably sunny scenario. Imagine if rates rise (only direction they can really go, though not likely in the short term) or if rents fall (they are already in some places!). That means your negatively geared property starts bleeding more cash. And then more cash. And then more and more cash the more rents fall.

How long can you support it? The rich folks will be alright. They’ll just ride it out or rearrange their affairs. But how long can you keep it up? You’re bleeding from a wound that doesn’t want to heal.

If this report can save you from that fate, then it will have done its job.

A hard truth

So this is the truth about negative gearing. It’s the story of ordinary investors being mobilised to defend a system designed by the rich to benefit the rich.

That said, I sincerely hope that you will be rich one day too.

Then, I think you’ll find negative gearing to be a useful strategy. When you’re in the payout phase of your portfolio, when you have a number or properties and the flexibility to arrange your own affairs, you will probably find that negative gearing is a good way to optimise your tax.

Which is exactly what I have found.

But don’t jump the gun. If you’re still in the construction phase of your portfolio – if you are still acquiring properties and establishing income streams to give you a bit of distance from the 9 to 5, then stay the hell away from negative gearing.

Negative gearing was not designed to serve you. In fact, it was designed to make investors nervous about their position and more easily mobilised into political action.

Now I totally get it if all this just makes you want to throw up your hands and walk away.

And I also understand if this report makes you angry – if it makes you want to get active and start campaigning for political change. I’m telling you, you’re going up against some powerful vested interests and change isn’t going to come easily. But sure, if you want to send a copy of this report to your local MP, go for it.

But first things first. Protect yourself and protect your family.

Because negative gearing isn’t the real villain here. Ignorance is.

But now you know how the system works. Now you can game the system for yourself. From where I sit, the tide seems to be shifting. Public opinion is divided. This report will get out there.

There’s a growing mood for change.

So there’s a window of opportunity here. If you’re in the construction phase of your portfolio and you have negatively geared properties, time to start transitioning away – consider strategies that can increase the rental return on your properties.

And for a short time, you still have cover from those investors who don’t know what a scam negative gearing is. They’ll figure it out eventually, and I’m doing my bit to tell them, but in the meantime they’ll keep chasing properties with atrocious yields.

The more that leaves for savvy buyers like us.

We also have some sophisticated strategies for building cashflow and equity – the stuff that really makes you money. Stay tuned to Knowledge Source for that.

But now you are warned. And now you are armed.

Ignorance is the real villain here. Don’t fall into its trap.

Wishing you all the best with your investing career, whatever shape it takes.

Jon Giaan

[1] http://www.theaustralian.com.au/national-affairs/treasury/turnbull-and-morrison-supported-negative-gearing-shift/news-story/582c5b4f48784e8d20ac1573041aafa1

Wow, I’m gonna need some time to process all that. I always knew I didn’t want to become a slave to the system locking myself in a prison for 25 years to pay twice as much as was written on the sales agreement but this … this has opened eyes and given me a headache … I NEED COFFEE !!!

In 1982 Labor said they would never introduce a CGT, but they did in 1985 with no warning. Gains would be taxed on actual rise after accounting for inflation. In the late 1990s the Libs stated they would abolish CGT for assets held more than 5 years, ie non-speculative, however they didn’t. But by 1999 the adjustments for inflation were “simplified” by giving a 50% discount if held more than 12 months. This is good for say 2 to 7 years of holding, but is worse for long term holding.

The focus of property data on the capital cities is a distortion and inappropriate. My first property (in the 80’s) was in Newcastle, a city much larger than either Canberra, Hobart or Darwin which are included in the stats but Newcastle isn’t. The Newcastle market is a little related to the Sydney market but not directly. Property prices are about half of equivalent property in Sydney. When Keating dropped Neg. Gearg. in 1985, rents soared in Newcastle. When he re-introduced NG in 1987, rents dropped back down to 1985 levels, not just in real terms but even in actual dollar terms. This is not shown in those rent stats but was still a real affect. Other large regional cities may well have had similar NG impacts. Millions of Australians live in 100,000’s of properties in regional towns and cities yet their property values are never included in national property stats. Why? doh!

66% (and rising) of the population live in capital cities. I can never grasp why these ‘tail wagging the dog’ arguments are so prevalent in the discourse on property.

Couldn’t agree more. Been investing since I was 21. I’m now 38. High income. 7x IPs. No kids.

I’m pretty much in the same position as if I just saved all that cash I spent on negative cash flow, deposits and LMI.

After suffering losses on 2 negative geared rental properties and making money on one positive geared holiday rental property over the last 5 years. Anybody that goes into an investment of any description with the intention of deliberately losing money is a fool. As John said, ” Its a smoke and mirrors game ” run by the rich.

The non existant ability to write down capital assets older than 20 years is poorly understood and adds to the non recoverable losses that the man in the street seemingly believes is GREAT for his portfolio. Its complete and utter rubbish.

There is NO loss making asset that makes sense for normal people to own……. end of story. Negative gearing is a fallacy put out there by people who have already MADE THEIR MONEY and want to keep the ball rolling so they can make MORE.

Jon, you haven’t provided the full story about the CGT. Yes, the Income Tax Assessment Act provides for a 50% discount on the net gain on the sale of an investment property. This sounds very generous, but this generosity is mitigated by the need to add back building depreciation claimed over the years you held the property. This means that someone on a relatively modest salary would easily be pushed into the highest tax bracket by the actual gain increased by the added back depreciation.

There is very little to no add back if you are not buying a new to relatively new property. Any profit gained added to income can be added to the lower income partner if you buy the property in the correct entity to start with!

So true. We were naive and fell into the NG trap. The property didn’t perform well and struggled against significant competition. We recently sold it before we went down the tubes mentally and financially. May as well have flushed $ down the toilet or gone out onto the streets and given money to strangers.

Thank you so much for writing this article. I’ve been trying to explain that to different people, but not many want to know that there is no Santa…..unfortunately…..They look like they understand what I’m saying, but don’t want to believe me.

Negative gearing to a degree adds stability to the national market. What we saw when it was removed was localized instabilities due to different economical positions in different locations. I think a valid point that’s probably been missed in all this is that generally speaking people do need an incentive to invest and that is what negative gearing and CGT discount (in modern times) is meant to do. I agree that’s it’s the combination of the two that really causes problems but there’s also a third element.

The liberals in the late 90s oversaw 2 of the big changes to the Australian housing market. The first was privatization of banks and the gradual deregulation of the banking system whilst still maintaining government deposit guarantees. Housing is a consumption product and if you allow people to simply borrow more then price will inflate in line with the additional borrowing power. This is exactly what we’ve seen happen over the past 2 decades with our national private debt borrowed against housing soaring through the roof.

The second was the change or simplification in the calculation of the CGTD which went from being an inflation adjustment to a flat 50% discount. This is a big change when you consider under the old CGTD calculation most would getting under a 20% CGTD based on inflation at most in current times on housing held for more then a 2-3 years. This idea of tax minimization in a rapidly growing capital price market referenced in the article would not of occurred without this change to CGTD.

As pointed out in the article interest rates and rent growth aren’t going to rescue these people and neither will more banking deregulation (international regulations are increasingly being pushed on first world countries) unless widespread fraud is committed in our banking system. For those who are interested there was a thesis investigation done on Loan Application Fraud back in 2013 which was on youtube that showed evidence that there was potentially systemic Loan Application Fraud practices within the big 4 banks of Australia. Of course even if the banks committing fraud does temporarily keep capital prices inflated in this country there is the added risk of the banks going bust when the fraudulent loans can’t be paid off.

Truthfully speaking this countries record bullish run has almost been entirely funded by credit and not hard work so come the next 5-10 years at some point there is going to be a lot of a pain for every Australian.

Labor was spot on and the Liberals were serving the far right elites and rich. NG should ONLY be on NEW properties. This will increase new supply, increase jobs in the building industry, stop seasoned investors bidding against OUR kids and first home buyers for established properties and normalise the market to a point where it is not so out of control. I wonder if the top 1% (wealth wise) of voters were not liberal voters…and the pollies did not own so much damn property that is NG…if things would change. John is spot on..it is a scam engineered for the top income earners. They must be laughing their damn heads off at mum and dad investors who NG. Our economy is based on Housing right now and it is disgusting to watch. No one is growing anything or building anything of worth in regards to business etc…they are just borrowing money and hoping that the properties gain in value over 10 years. I hope it all comes back to bite the pro’s on the ass.

Labour party voter I assume, not criticising, just asking. its interesting the difference. I have invested and been lucky, but i had to work very hard and make allot of sacrifices and risks to do it.. I respect your opinion, mine is just different, cheers,

Had the thought crossed your mind that many of these “selfish retirees” spend their property income on survival? It’s tough getting a job when you are over 60 so for many self-funded retirees property income is their sole source of income. I think you need to take personal responsibility instead of blaming the baby boomers. I can give you names of at least 2 guys (I am happy to supply you with their names and Facebook pages on request) in their early thirties that own nearly 300 properties between them. If they can do it, why can’t you?

Hi Dave who are the two guys?

shame on this website for allowing jon to write articles here, who basically changed his name to avoid recognition after being banned by ASIC

http://asic.gov.au/about-asic/media-centre/find-a-media-release/2004-releases/04-339-asic-restrains-wealth-creation-spruikers/

Jon and knowledge source sells you courses and education material worth thousands of dollars. Once money is given it is difficult yo get back despite cooling off period. You can’t even talk to Knowledge source people directly. All phones goes to messaging service. Only communication is bia email. I had lots of trouble getting my money back. ASIC has clearly warned about this website and Jon. My advice is don’t give them your money.

In response to the calls to limit negative gearing to new properties, the building of community within ‘greenfield’ estates is best achieved by having a high percentage of owner-occupiers. Re-focusing investors to these locations will result in lower levels of owner-occupation and increase price competition in the housing segment most accessible to first home buyers.